by Michael R. Allen

Today Alderman Antonio French (D-21st) introduced Board Bill 78 to make his ward one of the preservation review districts governed by the city’s preservation ordinance. Preservation review allows the city’s Cultural Resources Office to review demolition permits in the ward and deny them based on the architectural merit and reuse potential criteria established by the ordinance.

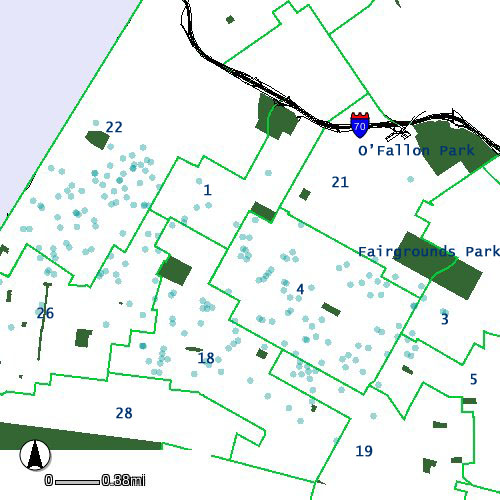

The 21st ward is one of nine city wards that are not preservation review areas. Here is a map showing the distribution of wards that do not participate (in white):

This map shows that the area covered by the McEagle NorthSide project (mostly the 5th and 19th wards) is not included in preservation review. Neither is most of the north city swath in which Urban Assets and other holding companies are buying buildings and land.

A ward’s lack of preservation review enables demolition on a wide scale — not necessarily all at once, either. The conditions of many wards without preservation review have deteriorated through the loss of one building at a time for decades. Loss of buildings means loss of residents, loss of job and loss of a sense of community — adding up to conditions that make wards vulnerable for land-banking. Preservation review is not designed to keep every old building standing forever, but to create a mechanism for careful decision-making about the physical resources of our neighborhoods.

Alderman French has a great ward with a largely intact building stock. Placing the 21st ward under preservation review will help keep the 21st ward in good shape for generations to come. By making the move to place the ward under such review early in his tenure, French shows that he will be working to protect and strengthen the neighborhoods he already governs, rather than jockeying for the big development that can shatter communities.