by Michael R. Allen

Planner Mark Johnson from Civitas has had a major hand in developing McEagle’s plan for north St. Louis and western downtown. On Monday night at Central Baptist Church, Johnson used the phrase “legacy properties” to describe the historic buildings that McEagle is contemplating including in the project. I have no idea what criteria Johnson or McEagle has use to define “legacy property,” but when I heard that phrase I started thinking about houses like the one showed above at right, located at 2552 North Market Street in St. Louis Place. (The house at left, at 2548 North Market, is quite a looker itself — check out that entrance arch!)

Planner Mark Johnson from Civitas has had a major hand in developing McEagle’s plan for north St. Louis and western downtown. On Monday night at Central Baptist Church, Johnson used the phrase “legacy properties” to describe the historic buildings that McEagle is contemplating including in the project. I have no idea what criteria Johnson or McEagle has use to define “legacy property,” but when I heard that phrase I started thinking about houses like the one showed above at right, located at 2552 North Market Street in St. Louis Place. (The house at left, at 2548 North Market, is quite a looker itself — check out that entrance arch!)

Readers might recall last week’s post “Brick Thieves Return to St. Louis Place” that showed how a house at 2543 Maiden Lane was damaged by criminals earlier this month. That house is just east and south of the ones shown above. All are highly visible from Jefferson Avenue.

Why do I think that the modest house at 2552 North Market is so interesting? Well, the house is one of a few remaining frame houses that have brick front additions. If that doesn’t make sense, take a look at the rear of the house.

The rear is a one-story gabled frame home, with one room in front and a small addition at the back. This house dates to the 19th century. The front brick section, with one room on each of two floors, dates to a building permit issued on May 22, 1915. The cost of the addition was $500 to owner William Duerdick and his builder J. Scaumel. The result of the addition was a handsome, two-story brick front to match those of neighboring houses.

As St. Louis Place developed into a high-density, middle-class enclave, many early frame houses were absorbed into the emerging urban (brick) fabric through front additions. Simple frame houses could be concealed behind fronts as refined as those of any neighbors’ houses. A new look and more space arrived, while the usable original house was retained instead of being wrecked. What great architectural economy for growing families on a budget!

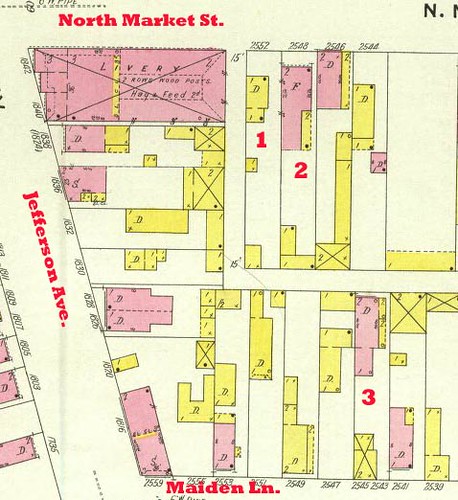

The 1909 Sanborn fire insurance map shows the footprint of the little frame house before expansion. That house is numbered 1, while the brick two-story house at 2548 North Market is numbered 2 and the flounder house at 2543 Maiden Lane is numbered 3. Frame is colored yellow, and brick is pink.

One can see that this area was not typified by any one form of house or method of construction. There are even a few vacant lots. Architectural diversity like this as historically common as the more regular patterns found in other parts of the city.

One can see that this area was not typified by any one form of house or method of construction. There are even a few vacant lots. Architectural diversity like this as historically common as the more regular patterns found in other parts of the city.

Lest I throw out my appreciation without offering any idea for how a developer like McEagle could reuse a quirky “legacy property,” I have a great example from another block in St. Louis Place. Here is the house at 1871 Madison Avenue, built first in the mid-19th century and given the brick front treatment in 1890. The style is different, but the form is the same.

The owners purchased this house from the Land Reutilization Authority, spent their own time and money on rehabilitation and ended up with a cozy homestead. The frame addition was in shambles, so they rebuilt it and finished it in earthen stucco. The roof on the frame section is a long-lasting metal roof, while the windows and doors are mostly recycled elements purchased at the ReStore and other places. A solar collector is on top of the flat roof of the brick front. Inside, the house makes great use of its small size with an open layout and a sleeping loft. The house uses stove heat in the winter, made possible by the small size.

While not historically accurate, the rehab of the house on Madison is inventive and green. The front-addition form is versatile and adds small-house options to the neighborhood for those who want to own a house but keep costs and house size down. the home on North Market Street is ripe for rehabilitation. The mansions of St. Louis Avenue tell one part of the St. Louis Place story, but that story is incomplete without the other parts. We can’t preserve everything that is left, but we should ensure that we preserve an architectural cross-section of a living, economically diverse neighborhood — so that we encourage that diversity to be part of the future as well as the past.