by Michael R. Allen

This magnificent house at 4200 Cook Avenue in the Vandeventer neighborhood attracts the awe of architectural enthusiast and neighborhood resident alike. Standing in the street and taking its photograph, several people commented to me that the house was a great one and hoped that I was there to buy it and repair it.

This magnificent house at 4200 Cook Avenue in the Vandeventer neighborhood attracts the awe of architectural enthusiast and neighborhood resident alike. Standing in the street and taking its photograph, several people commented to me that the house was a great one and hoped that I was there to buy it and repair it.

No dice, even if I wanted to. The house is owned by Urban Assets LLC, the new Harvey Noble-fronted holding company that is buying out north St. Louis. This is one of about 180 historic buildings that they have purchased since September 2008. Their purchase of the property is particularly disappointing because there once was a great plan to bring this house back to its former glory. All things pass, especially plans. Yet when the long-lived resources of a neighborhood pass, the chance for a sustainable future often goes with them.

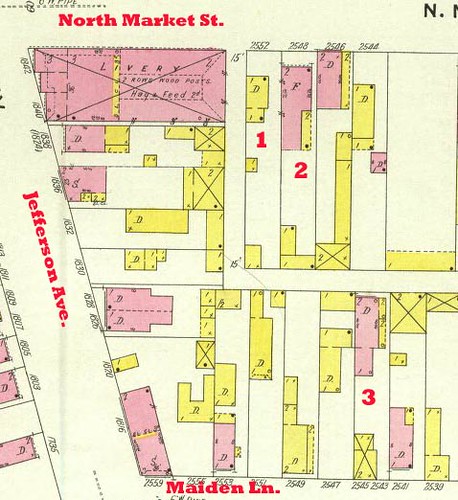

The house dates to 1892, when Richardsonian Romanesque had architects under its sway. This house employs many Richardsonian tendencies, like the Roman arch window facing Cook Avenue, the bow-front facing Whittier Avenue and the snug fit into the urban lot. This is a splendid house that may very well disappear. Critics can retort that the house was already well on the way to disappearing, which is true, but they would miss the real problem: no one else will have the chance to pull the house back from the ravages of fate. No human presence will be found at this corner for an indefinite time — no eyes or ears directed at the street, no kindness directed at adjacent residents.

Th acquisition pattern of Urban Assets LLC is highly troubling from a preservation perspective, but the bigger threat is spreading the neighborhood social disintegration that the McEagle acquisitions accelerated into more densely populated parts of north St. Louis. If the problems that land banking entailed in JeffVanderLou and St. Louis Place are cause for alarm, the effect west of Grand Avenue could be much worse.

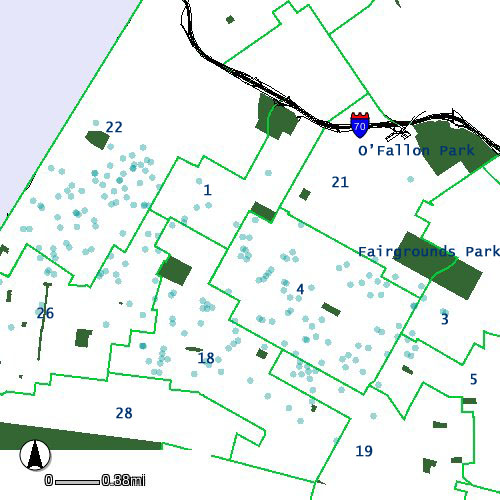

Aldermen whose wards are infected with Urban Assets’ property (1st, 3rd, 4th, 5th, 18th, 19th, 21st, 22nd, 26th) need to find out who is behind the purchasing and take the steps needed to safeguard their neighborhoods. This city doesn’t need another Blairmont — and I don’t mean in terms of political hoopla, but actual deleterious effect on the city’s people. Aldermanic leadership now can head off a potential development problem.